Your fiduciary duty never waivers, but whether federal or state fiduciary regulation applies depends on several factors. Nonetheless, Palladium Group will mirror your fiduciary obligation.

The word fiduciary has come a long way since Dick Van Dyke sang about it in 1964, even more so in the last decade. As a registered investment advisor, your fiduciary duty to act in the best interest of your clients is the cornerstone of your business.

In 1934, the Securities Exchange Act (“Exchange Act”) became law, forming the U.S. Securities and Exchange Commission (SEC) to restore the public’s confidence in financial markets. The Exchange Act permits the SEC broad authority over the securities industry, bringing stability to an ever-changing market by protecting consumers, maintaining fair markets, and ensuring transparency. However, the standard of care owed by those regulated by the Exchange Act essentially was limited to anti-fraud and later suitability. Transparency evolved with the passing of the Investment Advisers Act of 1940 (“Advisers Act”), creating an even more stable framework to regulate and monitor the activities of investment advisers. Over the years, courts have interpreted the Advisers Act that investment advisers owe a fiduciary duty to their clients.

Almost 35 years later, a new federal law, the Employee Retirement Income Security Act of 1974 (ERISA), expanded fiduciary responsibilities to retirement plans and those who advise, manage and control plan assets. As ERISA, the Exchange Act, and the Advisers Act developed, tensions grew due to the discrepancies of the care afforded to clients, particularly the seemingly lower standard broker-dealers had to give. As a result, there was an ongoing debate on whether a fiduciary standard or some other standard of conduct should apply for all investment advice. Fast forward to the Great Recession in 2008-09, dueling standards of care were front and center as part of the Dodd-Frank Act. Section 913 of the Act specifically dealt with the study and possible rulemaking for broker-dealers and investment advisors’ obligations to their clients. Not much came out of the study, except perhaps the groundwork for later regulation.

Contemporaneous with Dodd-Frank Act, the Certified Financial Planner Board adopted an updated Code of Ethics and Standards of Conduct that established a fiduciary standard for CFP® professionals. The CFP defines performing as a fiduciary “in utmost good faith, in a manner he or she reasonably believes to be in the best interest of the client — when providing financial planning or material elements of financial planning to a client.” This process became effective on October 1, 2019, and enforcement began in June 2020.

In 2010, the Obama Administration and Department of Labor (DOL) started its fiduciary rule restructure, culminating in a vastly different regulatory framework in 2017. However, this version of the DOL fiduciary rule was vacated by the Fifth Circuit in 2018. The Trump Administration and DOL picked up the regulatory torch and came up with somewhat milder changes to the fiduciary rule, which became final in December 2020. To the surprise of many, the Biden Administration and the DOL allowed the new exemption to become effective on February 16, 2021. Yet, recent comments from the Biden DOL suggest more to come.

Of course, we cannot forget the SEC’s Regulation Best Interest (Reg BI) that became effective July 1, 2020. Reg BI established four core obligations: Care, Compliance, Conflicts of Interest, and Disclosure; and, they apply to every recommendation of a security or investment strategy.

Not to be outdone, some states have imposed their own best interest rules, including the sale of insurance products. In 2019, New York’s Regulation 187 set best interest standards on the sale of annuities, only to be followed in 2020 by a best interest standard on the sale of life insurance — Reg 187 is currently being challenged in the New York courts. Additionally, in 2020, the National Association of Insurance Commissioners (NAIC) created a model best interest regulation for the sale of annuities with similar obligations as Reg BI, yet a bit different: Care, Conflicts of Interest, Disclosure, and Documentation. As of this writing, eleven states have adopted the model reg, with seven states considering it.

With all these differing laws and regulations, how does one remain compliant? Well, it’s not easy, but they all have a fundamental core consisting of key components:

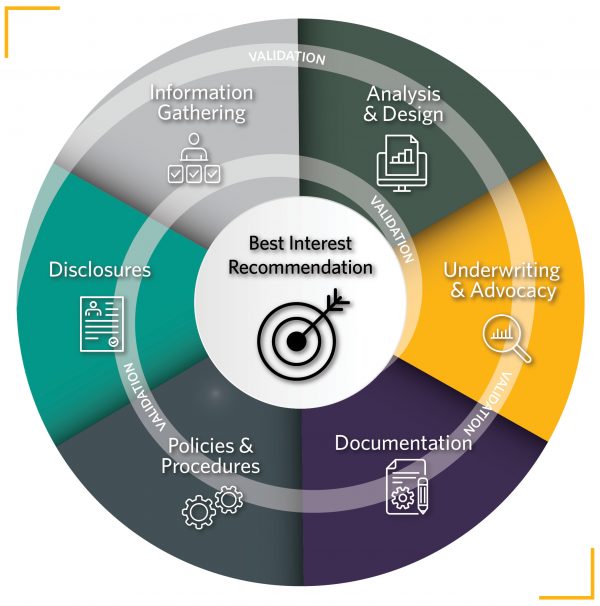

As an RIA, life insurance and annuities are assets you will encounter within a portfolio or consider as you develop a client’s financial plan. Your fiduciary duty never waivers, but whether federal or state fiduciary regulation applies depends on several factors. Nonetheless, Palladium Group will mirror your fiduciary obligation when recommending insurance products to your clients — always consulting and advising — never selling. Our guiding principles in applying fiduciary standards to life and annuities transactions are captured in the following diagram:

Palladium Group's Fiduciary Approach Model

Join Palladium Group in the Set Up for Success, Insured series. While the implications of the new regulations will apply to various investment products, this series will provide a granular level look at life insurance and annuities and outline the fiduciary duty through infrastructure, tactics, compliance, and applying best recommendations with your clients.

It can be challenging to make sure specific documentation and disclosure requirements are followed when different rules apply to different transactions. This series will enhance your knowledge and opportunities to demonstrate your valuable expertise to your clients. In partnering with Palladium Group, you will have confidence that your fiduciary duty is extended to all areas of your practice — including life insurance and annuities planning.

*This material is for financial professional and educational use only. Not to be reproduced or shown to clients.

Part 2: A Step in the Right Direction with a Fiduciary Infrastructure