Regulations mandate that you must have a solid infrastructure supporting your fiduciary practice before a best interest recommendation is made. Palladium Group views its fiduciary insurance infrastructure to contain 10 important key aspects.

A fiduciary standard in the life insurance and annuities industry is a relatively new occurrence — as we outlined in our initial blog of this series. Insurance regulators didn’t really enter the world of fiduciary requirements until 2019 and 2020 with the adoption of New York Regulation 187 and NAIC’s model best interest rules, respectively (the NAIC model rules have been adopted by 16 states with 8 more states soon to come). What’s interesting about the more “modern” fiduciary regulations, including the SEC’s Regulation Best Interest, or Reg BI, is that they don’t just focus on the prudent process of the transaction itself. They also codify things like compliance practices, conflicts management, and disclosures.

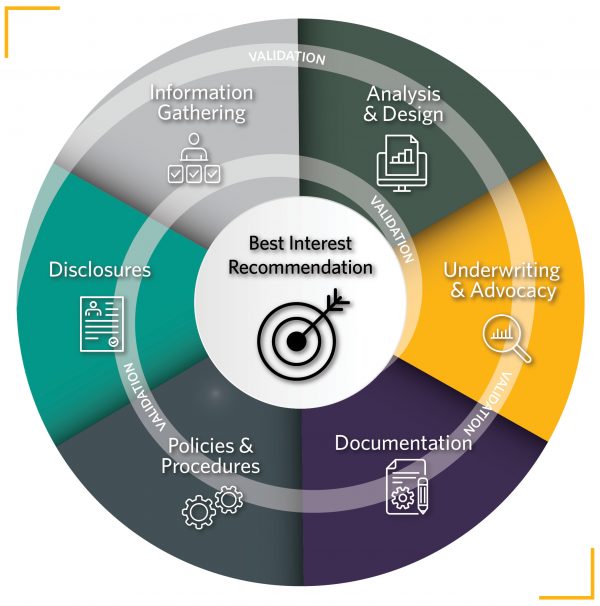

In essence, regulations mandate that you must have a solid infrastructure supporting your fiduciary practice before a best interest recommendation is made. Palladium Group views its fiduciary insurance infrastructure to contain 10 key aspects:

Palladium Group's Fiduciary Approach Model

There are several factors we consider in a due diligence review of an insurance carrier, but the primary factor at the carrier level is the insurance company’s ability to pay claims. Insurance ratings are a start to make this determination, but they shouldn’t be the only item; COMDEX ratings and ALIRT scoring supplement this evaluation. Of course, digging into the financials of a carrier and having the ability to understand a company’s capitalization is a plus. Notably, this information is easier to obtain from publicly held companies than privately held or mutual companies. At the product level, it is essential to have a variety of product types, basic features, and availability of certain riders. Most products will pass due diligence, with the exception of those with excessive fees and unreasonable surrender periods or charges.

Palladium Group also treats data feeds as a primary due diligence item. While this may seem like table stakes in the financial services industry, it is a challenge for carriers to seamlessly provide relevant data. Palladium Group has minimum requirements for carriers to be on the platform, but our expectations will become more demanding as technology improves.

We also take into consideration experiential items as well, such as support, underwriting capabilities, cycle time, and placement success. These are more advisor and client service-related items, which can fluctuate over time and can be overcome with strong relationships but remain a critical part of the due diligence review. Although these are more subordinate factors for Palladium Group, extended challenges will, nonetheless, cause a carrier to be removed from the platform.

Sometimes there are situations in which a client cannot obtain insurance from a carrier vetted through Palladium Group’s fiduciary platform. This typically occurs when a carrier’s underwriting requirements cause a denial of an application. However, insurance is a dynamic product. There are other carriers that would issue a policy, perhaps because they specialize in certain risks or have a different view of underwriting. Palladium Group will work with “off-platform carriers” as part of its fiduciary obligation to find insurance coverage for a client, since Palladium Group is backed by the experience and resources of Ash Brokerage, a leading insurance solutions provider, with access to more than 80 insurance carriers. By utilizing our fiduciary approach to insurance, fiduciary advisors can have confidence that they can still achieve a client’s best interest to secure life insurance protection.

Fiduciaries are uniquely positioned to engage clients in a discussion about life insurance and risk management, as it can greatly enhance and protect client portfolios. With Palladium Group, we can help you navigate the complex realm of life insurance.

For our next blog, we will cover the other nine aspects of a fiduciary infrastructure in the Set Up for Success, Insured series.

*This material is for financial professional and educational use only. Not to be reproduced or shown to clients.

Part 1: Palladium Group’s Fiduciary Approach