“Help your client use uninvested assets to protect the future of their business.”

A 50-year-old business owner, Dave, has a dilemma. His company historically carries approximately $1 million in cash. It’s currently earning 0.5 percent in interest. Unfortunately, none of his family members are interested in taking over the business, including his wife, Sharon. He doesn’t know what would happen to the business in the event of his death, but one employee, Ashley, possesses the skills and experience necessary for the task, and she’s expressed an interest in following in Dave’s footsteps.

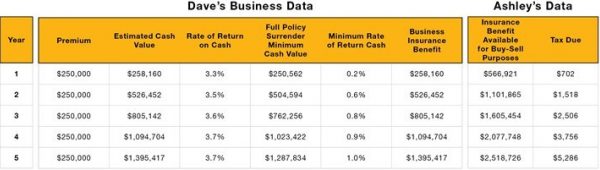

An insurance policy on Dave’s life is purchased by the company for either $250,000 or quarterly annual premium payments. The death benefit amount above the policy’s cash value is endorsed to Ashley. In the chart below, it’s clear that Dave’s rate of return will far exceed the current 0.5 percent return from the bank. At the same time, Ashley, as beneficiary, would be able to make a significant down payment to buy out Dave’s wife, Sharon, if something should happen to Dave.

At Palladium Group, we believe that making the right decisions for your clients doesn’t have to be difficult. When a client’s future — or the future of the business they’ve worked so hard to build — is at stake, we’re here to help you provide more ideas, stronger resources and better answers. You don’t see “good enough” as the end goal, and we don’t either. Let’s do great work together.