Over the years, the DOL fiduciary rule has created cause for advisors to become more transparent with their fees and conflicts. We break down how the insurance industry is advancing with other aspects of the financial services sector due to the current ruling.

February 1, 2022, marked the date the current DOL fiduciary rule took effect, with the exception of the documentation and disclosure requirements for individual retirement account (IRA) rollovers (the compliance date for these requirements begins on July 1, 2022). As fiduciary advisors know, the current rule, or Prohibited Transaction Exemption 2020-02 (“PTE 20 – 02”), was finalized in December 2020, at the end of the Trump administration. It was originally set to take effect on February 16, 2021, but the Biden administration provided transitional relief through December 20 of that same year, and then later extended it through January 31, 2022. The DOL did not pursue prohibited transactions claims against investment advice fiduciaries who worked diligently and in good faith to comply with the Impartial Conduct Standards set forth in PTE 20 – 02.

Fiduciary advisors also know that one of the biggest impacts of the new rule was the confirmation that transactions in IRAs must meet a prohibited transaction exemption. Consequently, RIAs, broker dealers, and banks have been figuring out how to meet the elements of PTE 20 – 02 for a majority of their business. However, when it comes to the sale of insurance products, there is a longstanding alternative exemption. At the time of this writing, that alternative, or PTE 84 – 24, is alive and well, and compliance with the exemption for IRAs alleviates compliance with PTE 20 – 02.

The criticism that accompanies 84 – 24 is that it does not impose a best interest standard, yet there are hints that the Biden administration will address this alleged gap. However, 84 – 24 does require transparency of the compensation earned on the transaction. For each transaction, an advisor must disclose the first year and subsequent years’ compensation, and it must be approved by the client in writing. It is also standard practice to disclose important information in illustrations and other disclosure forms.

Moreover, any gap in the standard of care under 84 – 24 is made up by best interest standards and disclosure requirements under other regulations. If the insurance product is a variable contract, Regulation BI applies. Additionally, 18 states and counting — with at least four more recent states — impose a best interest standard on any sale of annuities, not just transactions in IRAs.

Over the years, the DOL fiduciary rule has created cause for advisors to become more transparent with their fees and conflicts. The insurance industry is no different. We are, however, bearing witness as it advances with other aspects of the financial services sector. That’s why Palladium Group always stays informed long before and after the implementation of ruling advancements to offer the best and most up-to-date education to RIAs. And, we always mirror our RIA clients’ fiduciary standards, including the transparency of our compensation model and the costs of the insurance products we distribute.

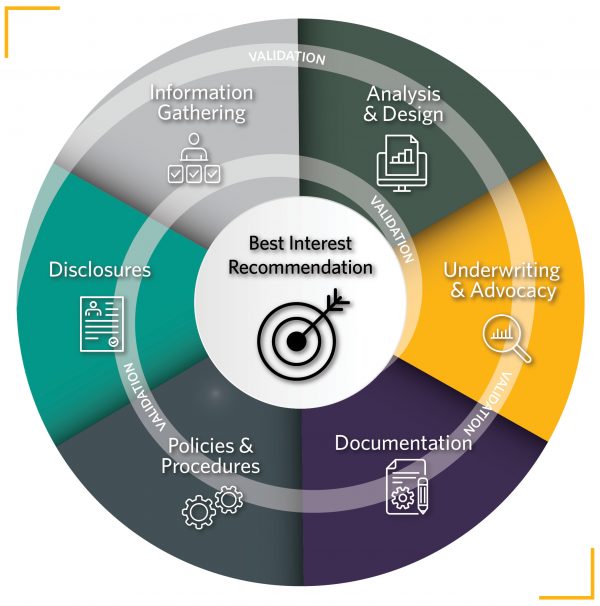

Palladium Group's Fiduciary Approach Model

As Palladium Group concludes its Set Up for Success, Insured series, our team of experts continue to look at life insurance and annuities through the fiduciary advisor lens. Yet, the Palladium Group fiduciary model approach does not stop here. Reach out to your extended team at contact@thepalladiumgrp.com and (888) 274‑5462 to discuss tactics, compliance, and applying best recommendations with your clients. Together, are success, insured!

*This material is for financial professional and educational use only. Not to be reproduced or shown to clients.

Part 1: Palladium Group’s Fiduciary Approach

Part 2: A Step in the Right Direction with a Fiduciary Infrastructure