“Risk is presenting itself in new ways. Do you know if the risk would have a low or high impact on your clients’ financial plans?”

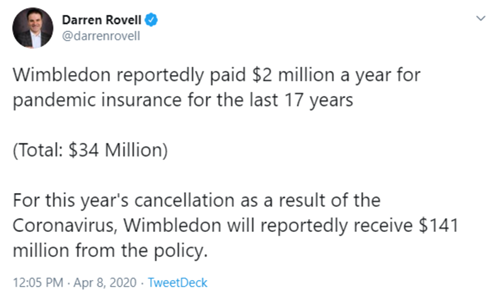

Darren Rovell, a sports business analyst most notably known for his time working at ESPN, made headlines back on April 8 when he tweeted that Wimbledon reportedly paid $2 million a year for pandemic insurance for the last 17 years. That $34 million in total premium may have seemed like a lot of money for such a low-risk event – until this year, when they reportedly received $141 million from the policy that was paid out when Wimbledon was canceled this year due to COVID-19.

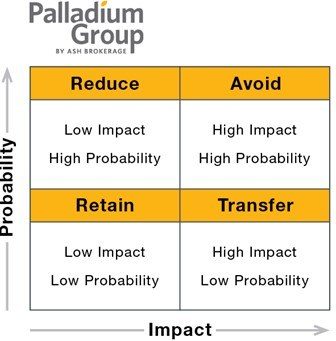

Now more than ever, risk is presenting itself in new ways. In our experience, advisors do a good job helping clients determine if the probability of the risk is high or low.

Equally important, but less often discussed, is determining whether the risk would have a low or high impact on the financial plan. In the blog post by Jonathan Millican of Bridgeworth Wealth Management, he illustrates the need for and advantages of transferring low-probability but high-impact risks. As he points out, there are some risks that are just too expensive to retain or reduce. And if you can’t avoid it, the best thing to do is transfer that risk, usually through insurance.

The COVID-19 pandemic has made 2020 a great time to re-evaluate your clients’ risk tolerance. As you meet with your clients for their monthly, quarterly, or annual review, ask them:

It’s not all “doom and gloom” for clients who decide they are no longer comfortable retaining some of the risks of their financial plan that they were willing to accept five or ten years ago. For those clients looking to transfer more risk to an insurance component, social distancing has caused insurance companies to innovate with underwriting and the entire application process. It is now possible to provide insurance to clients with a truly digital end-to-end solution that requires no paper application, no medical underwriting, and no need for any face-to-face contact with an agent or underwriter.

Also, with interest rates at all-time lows, your clients will probably never have more capital gains in their bond portfolio than they do right now. That makes a perfect time to “de-risk” some of these assets and look at planning for retirement income or long-term care (LTC) needs that are high-impact risks in retirement.

As financial planners and advisors, do you know what risks to insure for your clients? Do you know when to insure those risks? Are you prepared to balance the emotional aspect of insurance?

Let us know if you want to talk more about this.

*This material is for financial professional and educational use only. Not to be reproduced or shown to clients.