With the current state of the market, you may ask yourself, “is now really a good time to review existing life insurance policies?” The answer is simple. Yes.

In The Game of Life, a person travels through a simulated lifetime. From early adulthood, with the chance of college and a career, to marriage and possible children along the way, before eventually, getting to retirement. And depending on the version, purchasing automobile, homeowner’s and life insurance policies are even a factor with serious benefits. This classic board game seems to cover important changes one can experience in their life. However, as these events occur, there is one missing aspect of “life.” A life insurance policy review.

With the current market volatility, you may ask yourself, “is now really a good time to review existing life insurance policies?” The answer is simple. Yes. Because when products, such as variable universal life insurance, are reliant upon the market, your clients may no longer be on track with their financial goals. And depending on when you last reviewed your client’s policy, if ever, increased portfolio performance could result from available pricing improvements, medical underwriting advancements and long-term care riders that may not have been initially available.

With high interest rates on the rise, your client’s complete financial plan and goals may be changing. Whenever goals and objectives change, life insurance coverage needs to be reviewed to structure their policy to perform at its full potential, ensuring you are doing your due diligence as their advisor to structure their policy to perform at its full potential.

Let our team of experts complete the analysis for you to uncover potential changes that can protect your clients.

In this blog, we share two real opportunities and two real impacts that exist after a policy audit. First, let’s look at the basics of a life audit before jumping ahead on the board into opportunity.

When you help your clients build a comprehensive financial plan, it’s an ongoing process – including regular risk management reviews. As needs and circumstances change, so do the recommended solutions.

This typically means looking into your clients’ life insurance policies and making sure they are at optimal pricing and meeting current objectives. As insureds age, and children grow, homes are paid off and retirement nears, the purpose of their life insurance will change.

Although a regular life insurance review is important, there are triggering events that might require more immediate action:

These events are great conversation starters to reopen the discussion around life insurance and protection planning. Running a needs analysis, reviewing retirement income strategies or improving underwriting on current policies are items that arise and could lead to better outcomes for your clients. Let’s take a look at a couple of opportunities.

Your clients and prospective clients aren’t the only ones that need to understand the value of a policy review. Centers of influence and referral relationships, including CPAs, business and estate attorneys, and trust officers, often need a resource for an objective look at in-force life insurance policies.

New clients usually come with old policies. Many times, an old policy will be one of the first things they ask about. The fact is, there is constant turnover in the financial services world, and these orphaned policies are a typical occurrence rather than an exception. This presents a great opportunity for you to add value to clients and develop new relationships.

When clients purchase permanent life insurance, they likely have a goal in mind, and policies are designed accordingly. Various factors, such as an interest rate, dividend, index crediting rate or subaccount returns are expected to perform as illustrated. However, it doesn’t always turn out as expected.

During a policy evaluation, our team will order in-force illustrations and policy data from the insurance company. This critical step will stress test the policy and show how it could perform under various assumptions. Then, adjustments can be made to stay on track with the current objective.

It’s a great chance for collaboration between you, your clients and your Palladium Group consultant. From the beginning to the end of the review process, you should discuss current goals and objectives, along with a current insurable risk profile. This information can then be used to recommend the best outcome for your client — whether it’s managing the current policy or applying for a new one.

It’s often easier to look at an example to understand the value the process brings. Below are two case studies and the impact the policy review had on their financial goals.

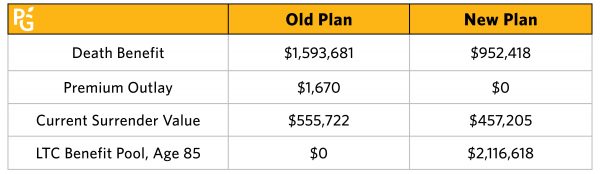

A 54-year-old female owned a whole life policy with about $550,000 of cash value. The client reviewed her objectives and coverage performance with her advisor and discovered a need for both long-term care (LTC) and life insurance coverage with access to the cash values in case of an emergency. Additionally, the whole life policy’s dividends were underperforming and declining.

In this solution, the carrier was able to accept the full exchange amount and divide the cash value between a linked-benefit LTC policy and a paid-up life insurance policy. The client created a large pool of LTC dollars, while maintaining a paid-up life insurance policy with a tax-free death benefit and access to cash values.

Successful Outcome #1, Summary

Next, let’s look at a thorough needs analysis of multiple whole life policies owned by a 55-year-old male. With roughly $325,000 of combined cash value and $3M in death benefit with an annual premium requirement of about $75,000, the advisor and client determined the total death benefit was not needed, and cash flow requirements were far more important. As an extension of their team, we worked to eliminate the high contract premiums and consolidate the coverage into one paid-up policy.

Here, the client was able to exchange about $325,000 of cash value into a policy with $1.4M of coverage. The new coverage plan is guaranteed for the client’s lifetime without additional premium.

There is no lucky spin or card to draw to get started, but it is fairly simple. If you have clients with questions about their existing life insurance policies, let us know. Your Palladium Group team, backed by Ash Brokerage, will collaborate with you to get a complete picture of your client’s goals. Then, we can help determine if their current coverage still makes sense, or if it’s time for something new. Regardless, we’ll work to provide your clients with the protection they need to be a “winner” in life. Reach out to an RIA Consultant by phone or email to learn more!

*This material is for financial professional and educational use only. Not to be reproduced or shown to clients.