“By doing your due diligence as a registered investment advisor, and by looking closely at all of the known components of your clients’ current circumstances and future plans, you can do your part to be sure their policy performs to its full potential.”

When asked the question, “what is one of the most valuable assets a person owns?” many of us might answer with, “a permanent life insurance policy.” This kind of policy, while necessary, is not purchased without making plenty of assumptions about the future. No one can predict with total accuracy what the market may do or what personal developments may transpire and, therefore, the future your client expects might not be the future they come to experience.

This is why a careful audit is vital. By doing your due diligence as a registered investment advisor, and by looking closely at all of the known components of your clients’ current circumstances and future plans, you can do your part to be sure their policy performs to its full potential. Regardless of the results, an audit instills confidence in decision-making and will strengthen the RIA/client relationship.

The beauty of conducting a life audit is that it doesn’t necessarily mandate a policy change. Rather, it’s a chance to take a step back, survey your client’s existing policy, and educate them on their best options moving forward.

This is one of many ways to demonstrate your dedication to your clients’ best interests, reassuring them of your expertise and willingness to forge a deeper ongoing relationship. Taking this step shows that your investment is in supporting the person, not in selling a product.

More Experience, More Efficiency

Of course, proficiency in these matters can be paramount, and turning to an experienced team like the one you’ll find at Palladium Group can make this process even simpler to manage. Our combined decades of work in this area means we’re well equipped to handle any issues that might arise.

Putting Client Satisfaction First

A life audit can be so helpful, many clients will be quick to refer family members, friends, or acquaintances who may also find the process beneficial. Satisfied clients who sing your praises will bring more business right to your doorstep; this easy addition to your practice may also be of interest to clients of estate-planning attorneys, trust officers, CPAs, and others.

The Audit Process

To begin an audit process, it is necessary to obtain the in-force ledger and other relevant data from your client’s existing policies. Additionally, key information like the client’s goals and medical information should be gathered for use in the analysis. Next, the policies can be analyzed to determine past performance, as well as potential future performance. Depending on the client’s circumstances, different scenarios can be projected (i.e., if they stop paying premiums, if they leave the policy as-is, etc.).

When you work with Palladium Group, we will handle the complete audit process for you — beginning to end. From obtaining in-force ledgers to presenting a comprehensive report detailing the audit results and our recommendations, you can be assured that a comprehensive evaluation of your client’s coverage has been completed. Further, your client will have access to the Life PreView tool, which allows them to easily and electronically complete the necessary background and medical information in a matter of minutes.

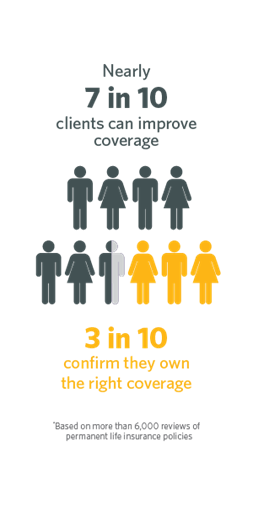

A Must for Policyholders

If a client owns life insurance, then they are an excellent candidate for a life audit (yes, that means just about everyone). But there are two specific criteria that, when met, mean a policy would benefit most from this type of review: those that are at least 10 years old and $50,000 in cash value or policies with annual premiums of $5,000 or more.

*This material is for financial professional and educational use only. Not to be reproduced or shown to clients.