If you haven’t reviewed your clients’ estate plans lately, now is the time to have the conversation to help ensure they can leave more to their beneficiaries and future generations.

The political winds shift quickly, and come Jan. 2026, the federal estate and gift tax exemptions are sunsetting. Are your high-net-worth clients ready?

There are a few items on the table to consider. From the proposed elimination of the stepped-up basis to the inclusion of grantor trust assets in taxable estate. And with the increase in estate tax rates, waiting in general, but especially now, on estate planning or insurance could have significant costs. Insurance is an asset, not an expense. Be proactive.

If you are waiting to have the conversation with your clients, it could be too late. In this blog, we will discuss the substantial cost of waiting, how planning strategies can include more risk but also have sizeable upside and the ways insurance improves outcomes.

Like most strategies, insurance and estate planning take time to execute and work. They depend on growth of assets. And the sooner your clients start this process, the more likely they are going to be to safeguard their financial future.

As of Jan. 1, 2026, exemptions will sunset and be cut in half. Meaning exemptions will revert to the previous law’s $5 million level.

It’s likely your clients are concerned about the uncertainty of the current market, but taking time to create an estate plan now can:

To gain further understanding, let’s look at three strategies and tools to consider — beginning with the most common and simplest method, which can provide protection for future generations. In these strategies, we’ll look at Jane and John, who:

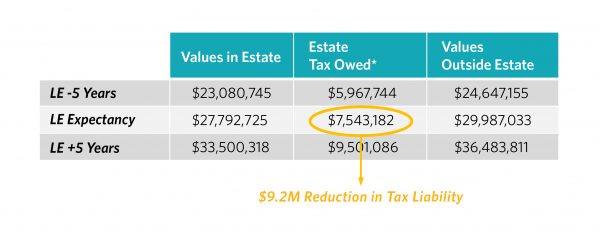

And despite a modest 3% return on their residence, liquid assets and private business at 4% (after-tax), with exemptions continued to increase at a 1% rate, John and Jane will still pay a projected $16 million in estate tax at life expectancy, under the sunset rule. In order to improve their outcome, let’s look at the first scenario.

The first strategy is a unique value proposition and approach that presents the opportunity to overperform and under promise.

With simple gifts of $16,000 per beneficiary of the trust, each child will receive $32,000 a year in gifts — with John and Jane gifting $96,000 a year in total. The $96,000 a year on John and Jane’s life insurance, yields an internal rate of return at 6.26%, essentially, the annual compound growth rate.

This strategy ultimately results in about $7.3 million of income tax free and estate tax free life insurance that can be used to pay their estate tax liability ($16 million of liquidity), which will be needed at the second death. Overall, the use of invested assets to fund the policy inside of the trust improves John and Jane’s outcome at life expectancy by nearly $4.3 million.

The second strategy we will look at builds in complexity but also maximizes flexibility. However, when setting aside a family bank, you should be careful with the flexibility and reliance, and ensure you work with tax and legal counsel.

In this scenario, John and Jane will create a family bank with tax-deferred liquid assets. Each spouse will have the ability to access the funds. Yet, they are putting those assets into a trust vehicle and will be moved outside of their taxable estate to pass the death benefit along to the kids, and possibly even grandkids.

Through a Spousal Lifetime Access Trust (SLAT), John can gift assets that benefits their kids and has Jane as an ascertainable standard discretionary beneficiary. Meanwhile, Jane gives to a different trust that has John as a discretionary beneficiary, and their children receive the balance of whatever remains.

This allows John and Jane to proactively think about wealth transfer, and if they need the liquidity, they can access it of their own lifetime. Or should they choose to, they can pull money from the policy and distribute it from the trust to help their kids with a down payment on a house. An important concept to keep in mind is the Reciprocal Trust Doctrine. And while your Palladium Group team of experts can help ensure trusts are not interrelated with no mutual value, it’s critical to work with tax and legal counsel that understand these issues from the beginning and can draft the language.

As John and Jane set aside $150,000 a year for seven years, they are creating a bank of liquidity that at age 85, is about $2.1 million for each of them. With this $2.1 million, they can:

The third and final strategy to put into practice is one that is more complex and requires more estate planning. On the latter side, it is also the most effective in terms of tax-preferential wealth transfer as it assumes continues growth in the business.

This idea that you can discount the value for lack of marketability, lack of control and non-voting interest, while slightly more controversial, is well-established as a planning practice.

In this example, John and Jane each set up an intentionally defective grantor trust with SLAT, and they gift $5 million each of non-voting stock in the privately held business.

In the case of a family held business, the value that a willing buyer pays will decrease based on the lack of marketability or lack of control and non-voting interest. These aspects lower the value for gift tax purposes, so when gifted, the minority portion of non-voting shares in that business may be worth far less than if the entire business was sold.

This allows the opportunity to “gift” it away and take what would have been $5 million as part of the estate and make a $3.5 million gift. It can reduce the estate but also freezes it, and any growth from that asset outside of the estate is not subject to estate taxes down the road. Thus, creating taxation and leverage opportunities in giving an asset with the potential of that growth, while also taking the available discount.

However, the more the asset grows, the more you may not want to liquidate it to pay for estate taxes. This is due to the fact that when you put this kind of asset into an irrevocable trust, your client no longer receives the stepped-up cost basis of that which you get inside the taxable estate. So, let’s say it’s a business that sits inside the trust with a basis close to zero, but the value is $10 million. In that case, if sold, will be capital gains.

This is where life insurance comes into play and provides the liquidity for it. With life insurance added back into estate planning, there is an overall outcome of $13.5 million with:

If you haven’t reviewed your clients’ estate plans lately, now is the time to have the conversation. Your Palladium Group team of experts, back by the Ash Brokerage Advanced Markets team, is here to help ensure you are maximizing the current estate and gift tax exemptions so they can leave more to their beneficiaries and future generations.

*This material is for financial professional and educational use only. Not to be reproduced or shown to clients.