“As your clients improve their financial literacy, it will profoundly impact their future and how they allocate their assets and save for retirement. This creates a significant opportunity for you. Everyone benefits from a more robust, financially sound plan.

Year after year, study after study, it becomes more apparent that Americans are inadequately informed about personal finance basics and are unprepared to face the challenges of the future. It is also no secret that our world has drastically changed over the last year as the coronavirus pandemic has disrupted the economy, thus making the work of improving Americans’ financial awareness and understanding all the more critical for April’s National Financial Literacy Month. Your Palladium Group team understands the importance.

As an RIA and a fiduciary, you have a role as a financial educator. Your clients look to you to answer their most pressing financial questions.

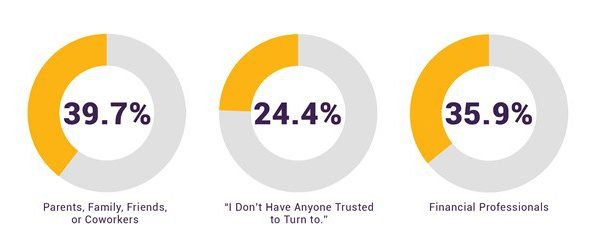

In a recent National Financial Educators Council (NFEC) survey, conducted between September 26 and October 2, 2020, 1,251 people across the U.S. were presented with a single question: “When you have a financial question, who do you turn to for trusted financial guidance?” The results are slightly alarming:

In a separate survey, NFEC’s Advanced Financial Literacy Test, of the 10,508 people participating, just 43% earned a passing grade while 56% failed. On average, only 58% of the questions were answered correctly. This test is focused solely on financial literacy topics and includes questions on loan payments, inflation, risk-based pricing, FICO scoring, loan qualification, and investment topics.

Financial literacy is the ability to understand the language that involves daily financial activities. When it comes to investing or saving, your clients need to understand the language involved. If they fail to, it can be challenging to discuss which plan is beneficial for your client. As they improve their financial literacy, it will profoundly impact their future and how your clients allocate their assets and save for their retirement. This creates a significant opportunity for you.

You can add enormous value to your clients’ financial lives when it comes to financial literacy. Your clients may not know how much money they should be saving for a comfortable retirement or the difference between a term and whole life insurance policy and which one is right for them. Tack on the complexities of Advanced Markets, and you will create a headspin.

Improving your clients’ financial literacy can increase their understanding and enhance your discussions with them. Financial literacy, no matter the client’s age or wealth, is vital for future preparation. It is most advantageous to start educating your clients as early as possible.

Within each topic, such as long-term care insurance or disability, you can include relevant, easy-to-understand resources, such as guides, tip-sheets, calculators, short videos, and valuable terminology breakdowns. Providing constant access to the information your clients need, with the ability to digest it at their own pace, is key to meeting your clients’ needs.

Your Palladium Group team is here to help. We emphasize mirroring your fiduciary duty and always act in your clients’ best interests. We guarantee you can leave complex insurance issues to us and focus on what you know best — helping your clients build a solid financial future. Working alongside you, Palladium Group is an extension of your services — your one stop for education, consultation, and analysis.

Everyone benefits from a more robust, financially sound plan. Significantly improving your clients’ financial awareness and financial literacy will have a significant, positive effect. Your clients trust you with their financial future. Now you need an insurance partner you can trust. Contact Palladium Group today for more information.