“How often are you checking in with your clients to ensure there aren’t gaps in their insurance coverage?”

Let’s face it. Insurance is one of those things that is often purchased and then forgotten until we’re approached about buying more or we receive a notice that our coverage is expiring. We don’t spend a lot of time actively thinking about whether or not we have covered adequately the potential risks in our lives in the same way that we think often about investments and growing our wealth. However, life happens and circumstances change, and if we don’t evaluate our insurance coverage regularly, then we put that wealth at risk in the long term.

Consider our approach to financial planning, whether that’s comprehensive planning or a specific area of planning like college savings or retirement. More than likely, your clients are investing systematically and reviewing this plan every year with you to make sure they are saving the correct amount, investing their dollars properly, and confirming their plan is still aligned with their goals.

The investment structure, amount, or frequency may change as their circumstances change, but by scheduling regular “check-ups,” you help ensure there aren’t any investment gaps.

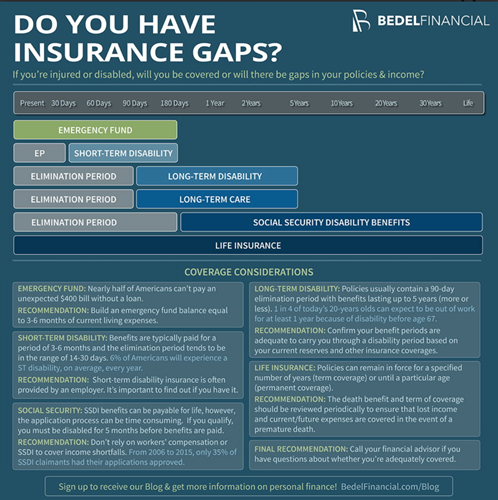

But what about insurance? How often are you checking in with your clients to ensure there aren’t gaps in their insurance coverage? This illustration from Bedel Financial, “Do You Have Insurance Gaps?” does a great job outlining where coverage gaps might exist and where to start the conversation with your clients.

Not only will every family have different answers, but every family’s answers will change over time as their circumstances change. Like investments, insurance isn’t a set-it-and-forget-it plan. While you may not have to make changes to your clients’ insurance portfolios as frequently as you do their investment holdings, it is still prudent to incorporate a regular insurance review with your clients into your overall planning process to ensure there are no insurance gaps.

Palladium Group’s insurance consultants will act as an extension of your team to help you navigate this process, and we will be a trusted resource to provide proper guidance for you and your clients going forward.

If you have any questions regarding this, let’s connect and talk some more.

*This material is for financial professional and educational use only. Not to be reproduced or shown to clients.