While a discussion around fiduciary standards may be relevant to many, the focus here is to identify and unpack some of the recent movements in insurance as it relates to advisors who have built fiduciary practices.

It’s a hot topic. A focus of conversation. And an evolving definition and standard of practice.

The word “fiduciary” has been the center of a tremendous amount of industry discussion for the last several years. The SEC, FINRA, CFP® Board, and even the New York State Department of Insurance all weighed in on the topic of insurance in a fiduciary setting. While a discussion around fiduciary standards may be relevant to many, the focus here is to identify and unpack some of the recent movements in insurance as it relates to advisors who have built fiduciary practices.

Insurance advice in a fiduciary setting often results in a discussion about advisor compensation, though advisors themselves are far more interested in providing client outcomes than an esoteric argument. While this question is certainly not novel (think of the advent of “no load” mutual funds), the insurance market has been slow to adapt. However, Palladium Group by Ash Brokerage recently released an industry-first “no load” or commission-free indexed insurance policy, specifically designed for the fee-based insurance advisor. Two guiding principles drove its ultimate design:

To take the analysis deeper, let’s take a look at a real case for a client of ours. This individual, a 46-year-old male, is looking to allocate $50,000 per year of nonqualified savings to an indexed contract. The strategy is designed to provide a needed death benefit (net of accumulated values in the policy) of $1,400,000 during the funding years and accumulate substantial internal cash values that are creditor protected and a hedge against tax increases.

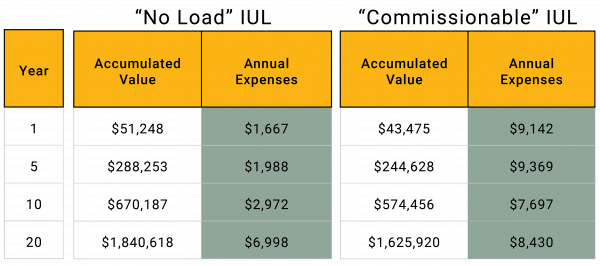

When analyzing the “no load” proprietary structure against an industry-leading commissionable product, the results are dramatic (see table below). Assuming the same net investment return — 6.03% — after 10 years of contributing $50,000 per year, the “no load” product has nearly $100,000 in additional cash value. The reason for the stark contrast is the lower annual insurance expenses.

This begs the question of the investment return. The “no load” contract offers simplicity with point-to-point index allocation options where the investment performance tracks the S&P 500, subject to a floor of 0% and a cap, currently at 10%. The retail alternative has a far more complex set of strategies with six different crediting structures that offer options with a multiplier and no asset-based charge, an asset-based charge and a much higher multiplier, no multiplier but with an interest “bonus,” or none of the above with a higher cap or participation rate. While some clients and advisors venture to understand the complexity of the latter option — and hope to have the same understanding in the future — the former would seem to lend itself to a clearer client understanding.

From March 2001 to March 2022, the Moody’s Seasoned Aaa Corporate Bond yield declined from 6.98% to 3.43% while 10-year Treasury yields plummeted from 4.98% to 1.74%. Life insurance companies are required to maintain the bulk of their reserves in fixed income instruments and, in turn, pass along value to the policyholder through the yield on those assets. As yields dropped, so did projected values for fixed insurance policies. Over the same 20-year timeframe, the average dividend projection for whole life products dropped from 7.84% to 4.83%.

With pressure mounting on the investment performance of interest-sensitive insurance policies, advisors and their clients often find these contracts missing expectations. Additionally, advisors have found that improvements can be made either by modifying the existing coverage or by repurposing the cash values into a newly issued policy with greater efficiency or that meets a different planning need. This has made the idea of a “policy audit” of permanent life insurance a crucial value-add to these clients and their families.

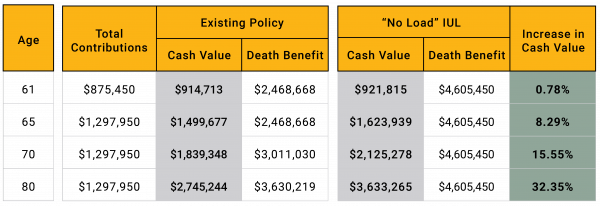

To give an example, we previously reviewed a whole life policy for a local business owner that represented “safe money” to him. The policy has seen a drop in dividend projections from over 5% in 2018 to 4% for 2021 and beyond, and the insurance company had announced a sale to private equity. The results of our review, which didn’t fully include the impact of the dividend reduction, allowed this business owner the opportunity to move to an insurance company with a more stable ownership structure and with significantly more upside potential using the “no load” indexed product. The projections — reflected in the table below — show a stark contrast in the value this business owner can expect in the future, not to mention a notable increase in his tax-free death benefit.

For many families, their most valuable asset is the ability to earn income. Using a simple present value calculation, the future earnings of a 40-year-old executive earning $350,000 per year are worth more than $3.5M (assumes a 1% annual increase, 6% discount factor). Yet, this executive may be inclined to insure her income exclusively with employer-provided life insurance and disability coverage.

Fiduciary advisors have grown in awareness of clients that fit this profile and are less likely to refer this type of business to a traditional insurance agent. Instead, more often they handle it themselves to control the process and ensure the best outcome. Take the executive in the example above. Her disability benefit would likely be capped at the lesser of $10,000, or 60% of income per month and would be reportable as taxable income. Her life insurance benefit would be limited to one to two times her salary. Both are woefully short of the $3.5M present value of future earnings and likely to leave her family in a difficult position if either are needed. Supplemental disability income and basic term life insurance are great and often inexpensive solutions to these shortfalls.

As a fiduciary planner looking to further expand your fiduciary knowledge and engage your client’s life insurance needs, the experts at Palladium Group are ready to help. These three trends can allow you to make a meaningful difference to your clients and their families, and we’ve specifically designed our value proposition to meet these unique needs.

*This material is for financial professional and educational use only. Not to be reproduced or shown to clients.